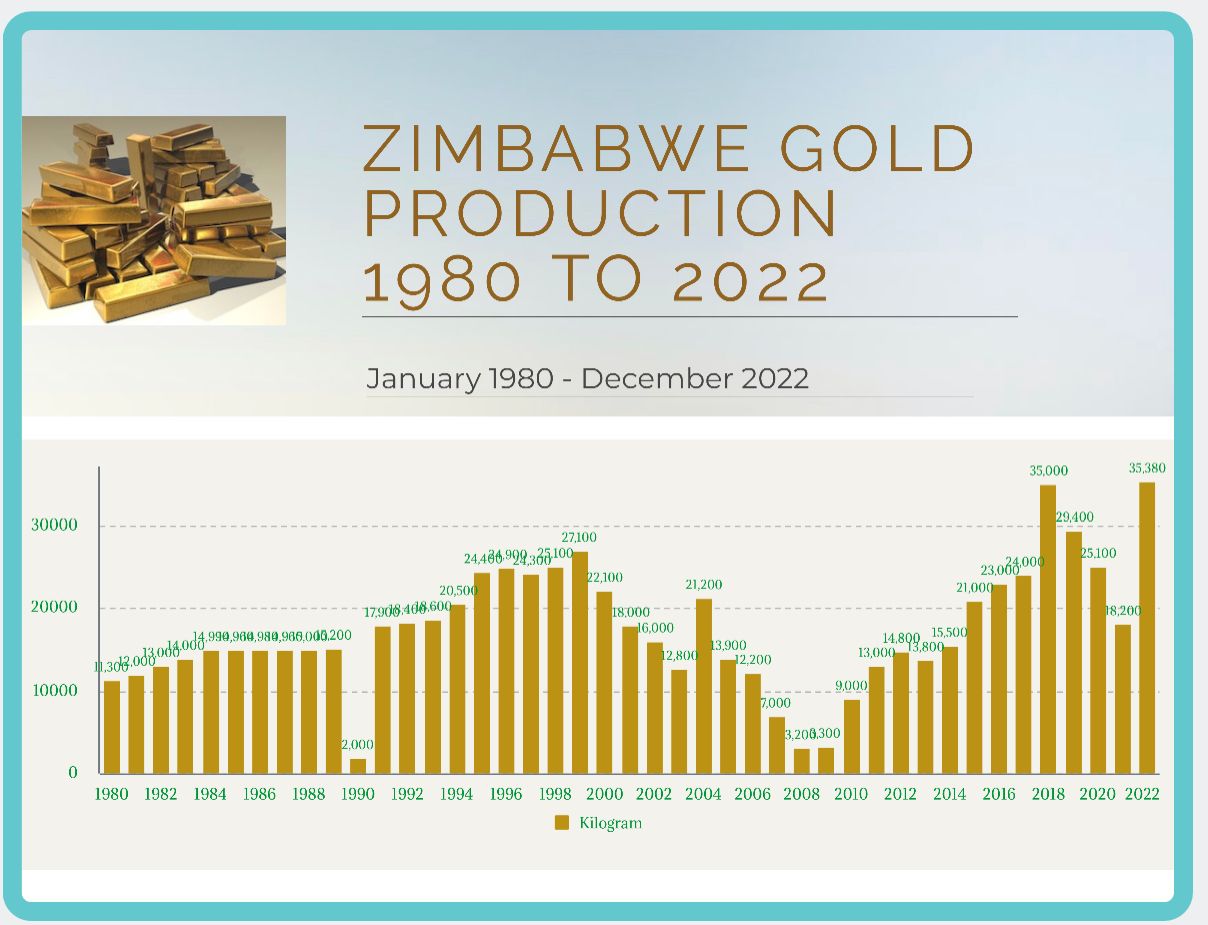

- Sanctions were imposed on Zimbabwe in 2001 which led to the departure of foreign investors, resulting in a significant decline in economic growth.

- During the same period, local investors in Zimbabwe, realizing that the economy was shrinking, began externalizing their money to tax havens and countries like South Africa and Dubai.

- The production of various industries, including gold mining, farming, banking, industry, and fuel, experienced a sharp decline.

- By 2008, Zimbabwe’s industry was dead, inflation was at an all-time high, and unemployment reached an alarming level.

- In 2010, local investors such as Kuda Tagwirei, Sandra Mpunga, Obey Chimuka, Shingi Mutasa, Divine Ndlakuka, Mataranyika, Simon Rudland, Rautenbach, McMillan, Bredenkamp and others who remained invested in the country, began to reinvest in the production of gold, fuel, services, farming, construction, real estate, retail, and other areas, as foreign investors were kept out due to the sanctions.

- As of 2022, local investors are making money and continuing to invest more, resulting in record-breaking production of gold, nickel, lithium, wheat, sugarcane, tobacco, and more.

Zimbabwe is currently experiencing an economic boom, with over $18 billion in savings in tax havens that could be attracted back into the country to drive the economy through local investment. If those with money in tax havens witness the growth of investment by those who remained invested in Zimbabwe, this wealth will come back to Zimbabwe.

However, using unsubstantiated rumors, such as the “Gold Mafia” documentary or various money laundering reports written over the years, to sanction or block the accounts of local investors in the name of FATF compliance. It could force investors to externalize their wealth instead of reinvesting it in Zimbabwe, as they did during the 2001-2008 period.

Some may have objections about specific local investors, but it’s undeniable that Zimbabwe is experiencing economic growth because of their loyalty in remaining invested and reinvesting in the country when everyone else ran.

Zimbabwe should therefore emulate tax havens like Dubai to protect such investors instead of inconveniencing them or criminalizing them to please Western countries that want to destroy Africa and wouldn’t hesitate to take the same investors as they did with Strive.

Just yesterday, South Africa announced that Dubai refused to extradite the Guptas, who were scandalized in South Africa and forced to flee. The leaders of Dubai have assessed and decided to keep the Gupta’s and their investment, rather than returning them to South Africa where they were criminalized, in order to protect white monopoly.

It is essential for African leaders to recognize the value of investors and take care of them, rather than destroying them and chasing them away to continue our dependence on aid and loans from the west, instead of collecting taxes from our investors.

Regarding our government in Zimbabwe. They must remember how tough the period of 2001-2008 was when foreign investment deserted us in an aim to crash our economy, while our business people are the only ones who stood with us. Appreciate those who stood with the nation during that time and to hell with FATF, the instrument of our sanctions senders.

This information was provided by Rutendo Matinyarare of ZASM.

https://www.iamrutendo.online/post/what-local-investors-did-for-zimbabwe-s-economy