The Herald has begun spreading lies about ZDERA being the cause of Zimbabwe’s current currency value challenges, which is nonsensical.

As part of their explanation for Zimbabwe’s currency decline by 45% over the past few weeks since the removal of executive order sanctions, the Herald claims that “The sanctions (ZDERA) have also criminalized any relations between international banks and Zimbabwean entities, making it impossible for the country to secure any liquidity to support its economy.”

This is utter nonsense because there is no single clause in ZDERA that prohibits or criminalizes private banks for having corresponding banking relations with or trading with Zimbabwean banks. Only the executive order sanctions EO13469, barred any financial institution from clearing the funds of, doing business with, or lending money to the government of Zimbabwe, institutions belonging to that government or entities doing business with it.

This is why we saw the cancellation of the Reserve Bank of Zimbabwe’s accounts in foreign banks only begin seven years after ZDERA was enacted, and days after the 29th of July, 2008, when EO13468 sanctions were enacted by George Bush.

Nevertheless, the offending sanctions were removed three weeks ago, so surely we can no longer blame them for latest currency fluctuations.

It’s therefore not true that ZDERA is blocking Zimbabwean banking activities with the outside world. But the problem is Zimbabwean bankers, who have become too comfortable with making money from charging exorbitant banking fees, are failing to reform and create new corresponding banking relationships with foreign banks, to offer a viable banking system that facilitates savings to support our currency.

The paper went on to claim that “The law (ZDERA) bars any American seconded to an international institution from approving commercial loans to Zimbabwe.”

Again this is a misrepresentation of the causes of our current problems, as we have never seen ZDERA being implemented by any U.S. Director in any multilateral lending institution, voting against Zimbabwe getting any loans since it was implemented in 2001.

This is because Zimbabwe stopped servicing its multilateral debts from 2000, thus, the nation is in arrears and not eligible to get loans from these institutions, until it has paid its outstanding debts.

Additionally, Zimbabwe has been receiving its SDR (Special Drawing Rights) from the IMF without any difficulties. Not only that, but we have been able to exchange those SDRs for US dollars when Zimbabwe had no US dollar reserves with the IMF. This means any exchange of SDRs to U.S. dollars without reserves, was borrowing of U.S. dollars reserves of other nations. Such SDR to US dollar exchanges were never stopped by U.S. directors, US banks that process all U.S. dollar transactions, or OFAC.

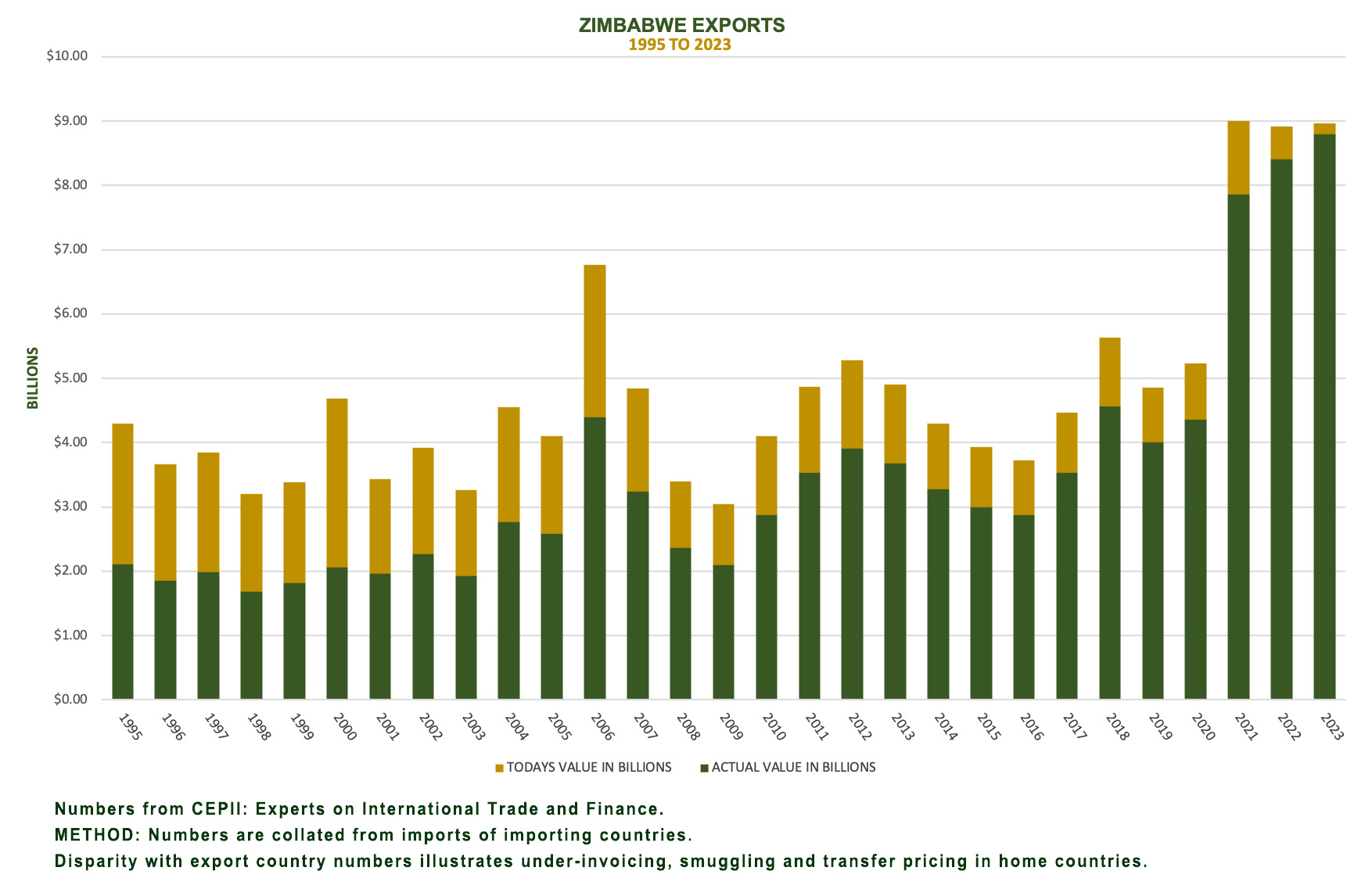

Moreover, no nation worth its salt depends on very exploitative multilateral lending institution loans to run its economy. Astute nations enhance their tax collection, issue bonds and increase their forex earnings to raise capital, to balance their payments. Besides, where is the 2023, $11 billion dollars of export revenue and the trade surplus, that the same paper was punting?

The truth of the matter is Zimbabwe is hemorrhaging foreign currency because Zimbabweans don’t trust their banking system and most of our foreign currency is leaving the country, after the Zimbabwe government allowed foreign-owned companies and foreign investors to repatriate 100% of their profits and debt repayments out of the country.

This has made Zimbabwe a colonial economy plagued by no savings and externalization of excess value. This is exacerbated by our use of the easy to smuggle U.S. dollar and government officials and the Herald who actively protect the biggest externalizers. This self-sabotage is now the problem in Zimbabwe, not ZDERA.

Written by Rutendo Matinyarare, Chairman of ZASM.

https://www.iamrutendo.online/post/the-herald-must-stop-misleading-us-about-currency-issues-in-zim