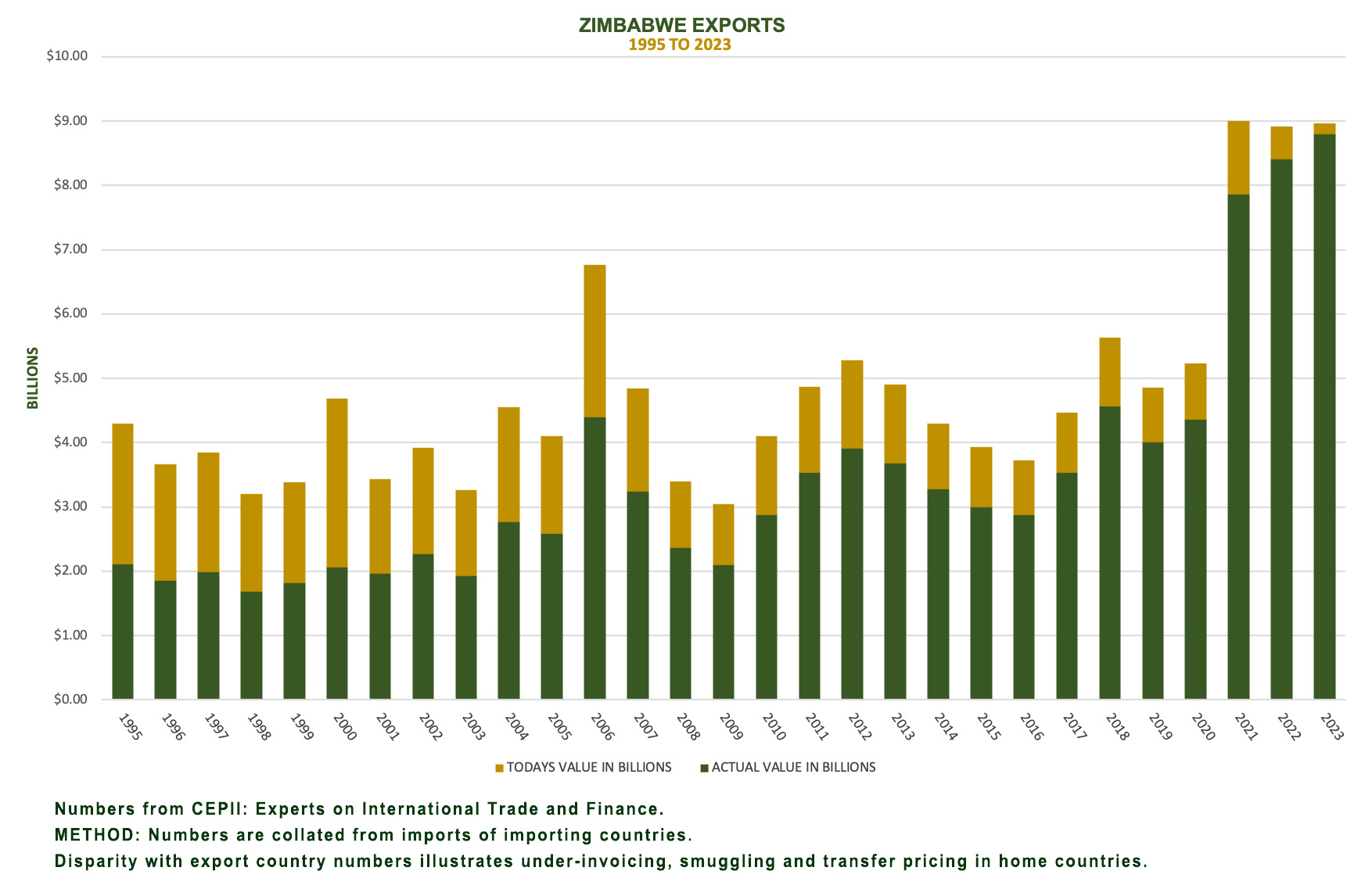

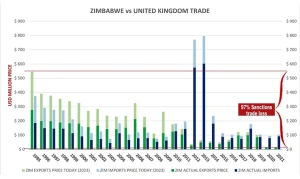

The British government has issued yet another statement explaining that their sanctions are targeted on only five individuals and one company. However, the reality contradicts their claim when examining the real reduction of Zimbabwean exports to the UK (green bar) and imports from the UK (blue bar).

Zimbabwean exports have dramatically fallen from a real value of $545 million in 1995 to $11 million in 2022. Meanwhile UK exports to Zimbabwe have also fallen from $186 million ($375 million in real terms) to $103.36 million in 2022.

These numbers demonstrate that sanctions have caused a 97% reduction in Zimbabwean exports to the UK and a 76.8% decrease in imports from the UK since the imposition of sanctions.

This unequivocally shows that UK, EU, and US sanctions on Zimbabwe have severely impacted the Zimbabwean economy. Moreover, these sanctions remain illegal according to international law and they are not targeted for the following reasons:

1. They are unilateral and lack due process, without the involvement of the preeminent multilateral institution (the UN), which is the sole authority authorized to sanction countries after conducting human rights impact assessments.

2. The UK’s claim that these sanctions target only five individuals and one company is misleading. This amounts to punishment without a fair trial, making these so-called targeted sanctions illegal and a violation of the universal bill of human rights.

3. Sanctions affect more than the specified five individuals and one company, as UK banks such as Westiminister PLC and HSBC closed the bank accounts of the Reserve Bank of Zimbabwe between 2008 and 2016 and have not reopened them since. This indicates that UK sanctions also affect the Reserve Bank of Zimbabwe which belongs to all Zimbabweans.

4. Standard Chartered, Barclays, National Westminster Bank, FBN, HSBC, and Lloyds Bank have closed branches in Zimbabwe and terminated corresponding banking relationships with all Zimbabwean banks since 2008, as late as 2023 when Standard Chartered ceased operations in Zimbabwe due to UK sanctions and the enforcement of US sanctions. This again means UK banking sanctions and overcompliance are on all Zimbabweans.

5. Zimbabwe’s exports to the UK significantly decreased from their peak of $299 million in 1995 to a mere $11 million in 2021, demonstrating that UK and US sanctions have totally impacted Zimbabwe-UK trade, resulting in an over 83% decline in trade in real terms.

6. In contrast, UK exports to Zimbabwe peaked in 2012 and 2013 under the Government of National Unity (GNU) when the UK exported over $1.5 billion worth of petroleum products to Zimbabwe.

7. The UK’s Department for International Development (DFID) has deliberately denied Zimbabwe aid for programs such as treating fruit flies and others over the past decade.

8. Several companies, including Sage, UK insurers, and auctioneers, continue to restrict services to Zimbabweans that include the purchase of second-hand ambulances, medical equipment, and machinery due to UK sanctions.

This assessment affirms the devastating impact of UK sanctions on Zimbabwe and the UK’s complicity in the resulting economic hardships in Zimbabwe.

Written by Rutendo Matinyarare, Chairman of ZASM.